At SurgePays, we are dedicated to bringing financial and telecom products to the underbanked and underserved populations across the United States. We understand that access to essential services shouldn’t be limited by traditional banking systems. That’s why we focus on reaching these communities right where they live and shop.

The Company

Market

The underbanked do the majority of their financial transactions at their trusted local convenience store that’s closest to their home. SurgePays utilizes these stores as the points of distribution into these communities. As we onboard stores to our fintech software platform, we enable the clerk at that store to perform transactions such as prepaid wireless activation and payments, along with reloading debit cards and other financially enabling services to improve the daily lives of those without traditional access to banks, credit and checking accounts. One of the really great things is that our revenue is directly tied to how many essential services we provide to those who need them most.

Vision

Build the largest direct distribution network of underbanked products and services. Our product suite gives us a competitive advantage in offering owner-operated and large chain stores compelling reasons to utilize our software platform. We gain strength and momentum by developing new products and services while growing our nationwide network of stores.

Wireless

SurgePhone and Torch Wireless are MVNOs providing traditional wireless services (Talk, Text & Data) over the AT&T and T-Mobile networks. We developed our Customer Relationship Management (CRM) software so that we have the flexibility to offer traditional prepaid wireless monthly plans and government-subsidized plans on the Affordable Connectivity Program (ACP). Our MVNOs currently provide wireless service to over 250,000 subscribers.

FinTech

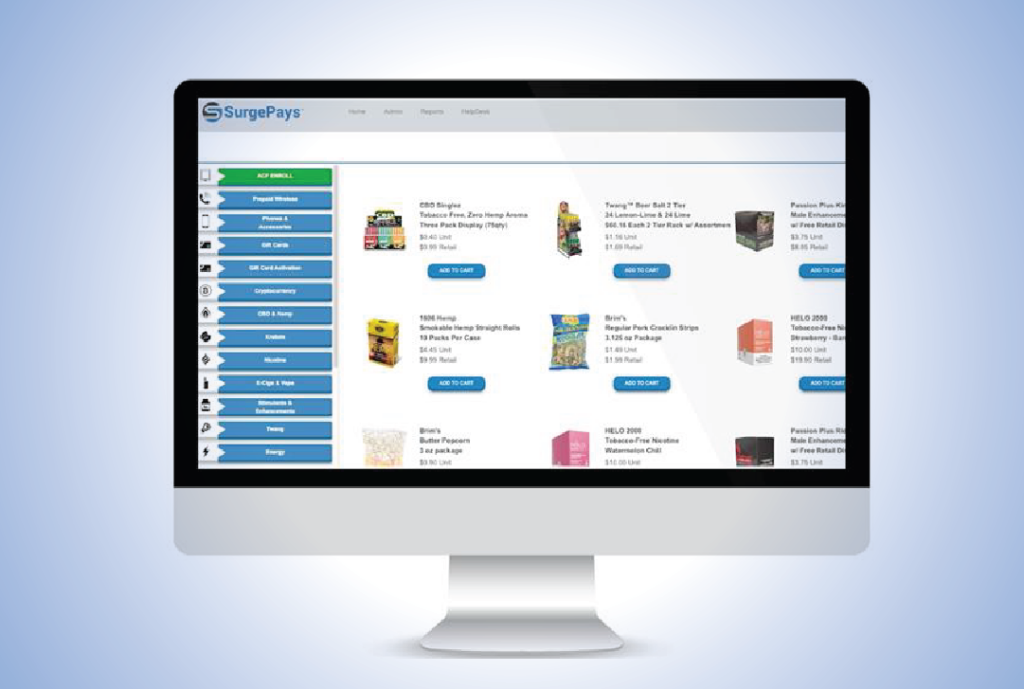

SurgePays software platform enables a store clerk to perform transactions at the point of sale. Initiating an ACP enrollment, activating prepaid wireless activations and top-ups, gift cards, debit card activation, loading, and providing other financially empowering services can all be done using our secure interface, similar to a website. Store owners make a percentage profit per transaction by providing these much needed and wanted services to the customers in their community. This model truly is a Win-Win-Win at a time when these customers are looking for convenience and to save money, stores are looking to increase marginal revenue, and we are looking to rapidly expand the national network of stores transacting on the SurgePays network.